20 teile/los Mutter Und Dichtung Für Britische System F Stecker CATV F Stecker Mutter Dichtung - AliExpress

Adapter USA Germany Plug with 3USB 1USB C , with 2 Socket Adapters, 6-in-1 USA Adapter Socket, Travel Adapter Type B Socket Adapter for America, Canada, Thailand, Mexico: Amazon.de: Electronics & Photo

20 teile/los Mutter Und Dichtung Für Britische System F Stecker CATV F Stecker Mutter Dichtung - AliExpress

Braun All-in-One Trimmer 3 MGK3245, 7-in-1-Bartschneider für Herren, Haarschneidemaschine, für Gesicht, Haare, 5 Aufsätze, Schwarz/Blau, ( britischer 2-poliger Stecker) : Amazon.de: Drogerie & Körperpflege

AIEVE 3 Stück UK auf EU Adapter, UK Typ G 3 Pin zum Deutschland/Europa 2 Pin Reisestecker Stecker Adapter Adapterstecker: Amazon.de: Elektronik & Foto

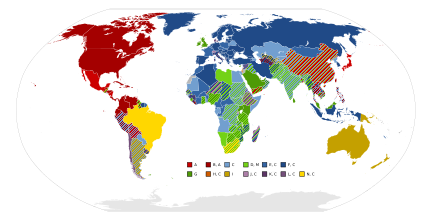

Reise Adapter Urlaub Stecker Europa GB USA Japan etc in Bayern - Feldkirchen-Westerham | eBay Kleinanzeigen ist jetzt Kleinanzeigen

UK to EU Euro Europe Travel Adapter with 2 USB Ports Grounded European Power Plug Adapter for Spain Russia France etc - Type E/F - AliExpress